cayman islands tax haven reddit

They have no income tax no property taxes no capital gains taxes no payroll taxes and no withholding tax. There are valid legal regulatory and legislative reasons that clearly demonstrate that the Cayman Islands is a transparent tax neutral jurisdiction and not a.

King Charles Made The Royal Family Richer As England Struggles

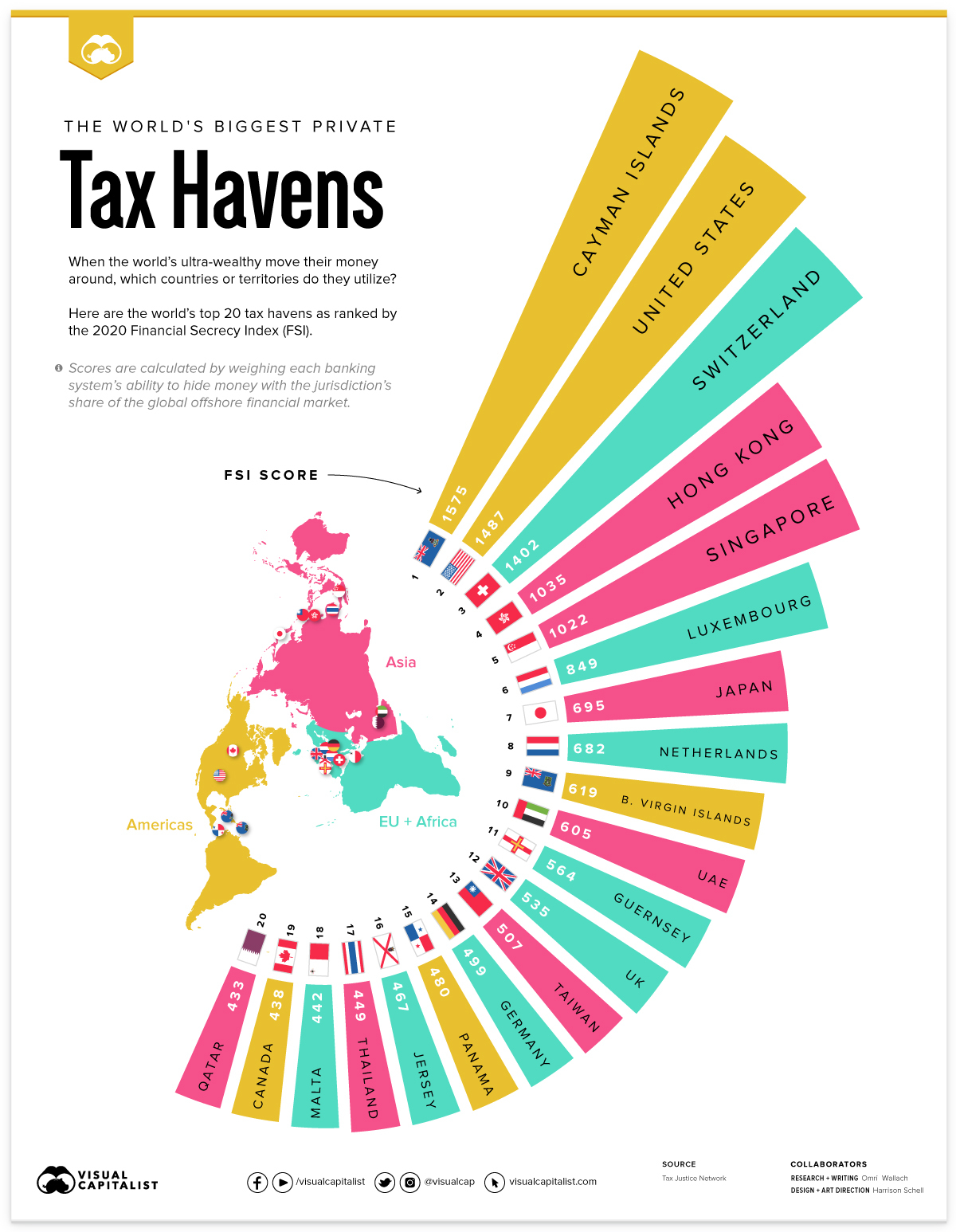

The Cayman Islands are not the only tax haven.

. This helps to ensure that taxes are paid. The Cayman Islands Offer Retirees More Than a Tax Haven A combination of amenitiessome man-made some created by natureare luring an increasing number of non-Caymanians. Cayman Islands Tax Haven Reddit.

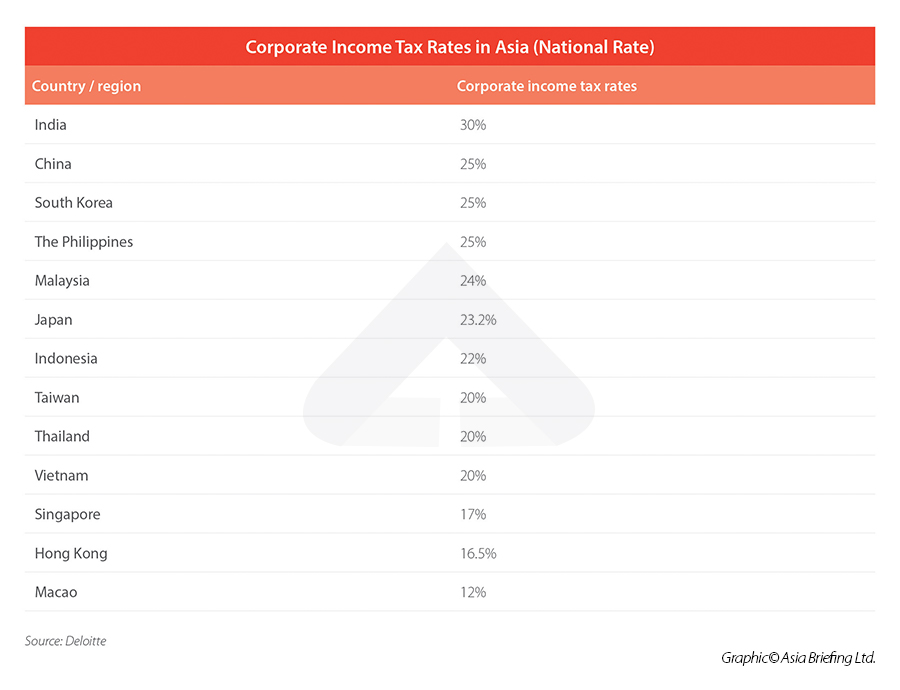

The duties on goods that are brought to the Caymans range from a whopping 22 to 27 according to Investopedia. One of the original pioneers of the Tax Haven Industry in the Cayman Islands Paul Harris was the first British chartered accountant to take up residence arriving from London in January 1967. Corporate Tax Rates 2020 Cayman Islands Government.

Tax haven Cayman does not tax offshore companies on income. Press J to jump to the feed. Solution The Caymans have become a popular tax haven among the American elite and large multinational corporations because there is no.

Why Are The Cayman Islands A Tax Haven. The caymans have become a popular tax haven among the american elite and large multinational corporations because there is no corporate or. The Cayman Island is a true tax haven in that it does not have an income tax.

Instead the government gets its revenue on duties tariffs fees licences and hotel tax. Cayman Islands Tax Haven Reddit. FATCA and CRS filings another 2k annually.

Answer 1 of 2. The Cayman Islands firm position is that as a global partner in fighting financial crime we share tax information with relevant law and tax officials. How Do Tax Havens Work.

Cayman Islands Tax Haven Reddit. Instead the government gets its revenue on duties tariffs fees licences and hotel tax. Other countries considered tax havens include Switzerland the British Virgin Islands Bermuda and Dominica.

Cayman Islands Government Ministry of Financial Services. There are exemptions such as items like baby formula however a. Why are the Cayman Islands considered a tax haven.

Living Tax Free in the Cayman Islands with their Wealth Residency by Investment Programs. Following the leak of the 149 reports of Mossack Fonseca yesterday the Cayman Islands a British Overseas Territory infamous as being a tax haven. Failing to do this would require your brokers to withholding 30 of.

Cayman will require an annual audit prob another 10k if done cheap.

The European Commission Is Chasing The Wrong Tax Havens Eu Reporter

Cayman Islands To Conduct Feasibility Study For New Subsea Cable Dcd

Netherlands World S 4th Biggest Tax Haven Nl Times

What Causes Long Covid Here Are The Three Leading Theories Science Aaas

Watch Hummingbirds Dance Through Waterfalls Science Aaas

2022 Grand Cayman Island Planning Guide Travel Caffeine

The Top 15 Tax Havens For Millionaires Around The World

Mapped The World S Biggest Private Tax Havens In 2021

What Is Beps 2 0 Oecd S Two Pillar Plan And Possible Impacts

Cayman Islands Put On Tax Haven Blacklist After Brexit

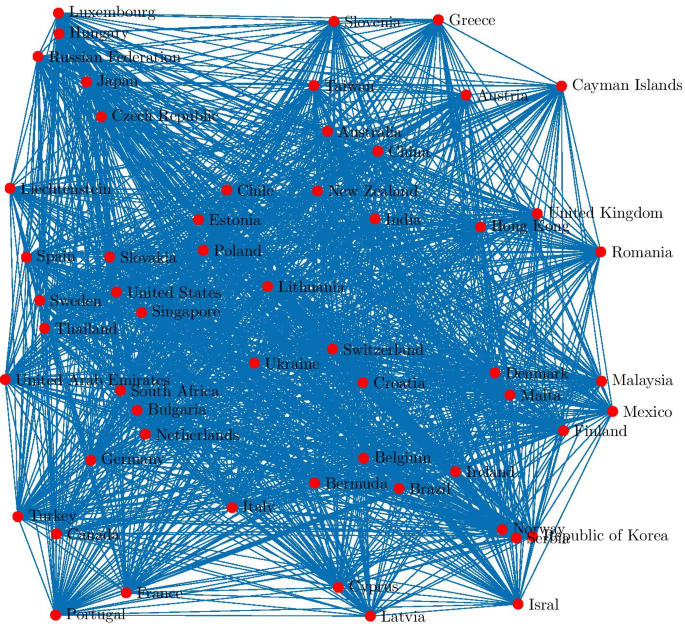

Structure And Influence In A Global Capital Ownership Network Applied Network Science Full Text

2022 Grand Cayman Island Planning Guide Travel Caffeine

The Hacker The Tax Haven And What 200 Million In Offshore Deposits Can Tell Us About The Fight Against Illicit Wealth

Eu Puts Cayman Islands On Tax Haven Blacklist Bbc News

What Is Beps 2 0 Oecd S Two Pillar Plan And Possible Impacts

Us Lands Top Spot As World S Biggest Enabler Of Financial Secrecy In New Index Icij

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/6288555/Screen%20Shot%202016-04-04%20at%203.25.21%20PM.png)

Panama Papers Why Tax Havens Matter In One Chart Vox

Tax Havens And International Business A Conceptual Framework Of Accountability Avoiding Foreign Direct Investment Temouri 2022 International Journal Of Management Reviews Wiley Online Library